DOGE Price Prediction: Assessing the Path to $1 Amid ETF Mania and Technical Breakouts

#DOGE

- ETF approval catalyst could drive institutional adoption and price appreciation

- Technical indicators show bullish momentum above key moving averages

- Mainstream acceptance and growing use cases support long-term valuation

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

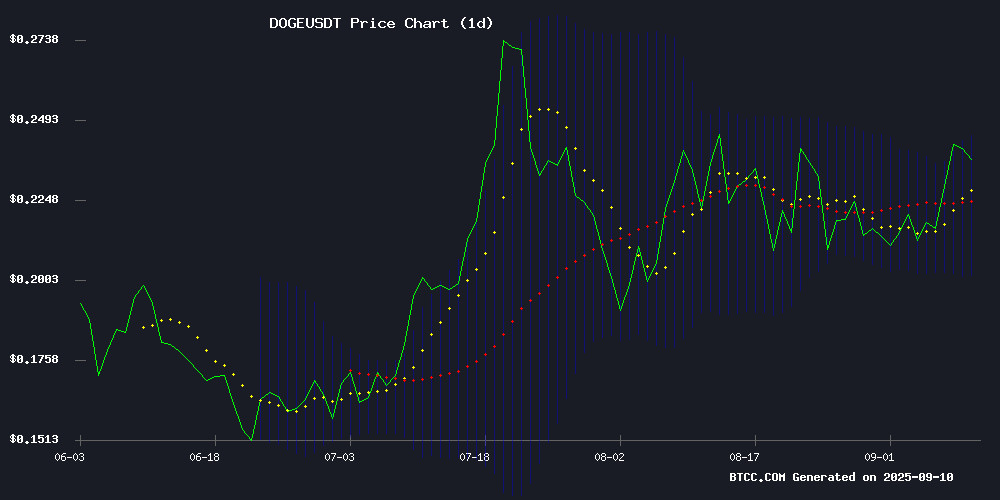

DOGE is currently trading at $0.237, positioned above its 20-day moving average of $0.223, indicating near-term bullish momentum. The MACD reading of -0.000608 suggests some bearish pressure in the very short term, though the signal line at 0.003466 and histogram at -0.004074 show mixed signals. The Bollinger Bands configuration, with price hovering NEAR the upper band at $0.244, suggests potential resistance ahead. According to BTCC financial analyst Robert, 'The technical setup shows DOGE maintaining strength above key support levels, with the $0.201 lower Bollinger Band acting as crucial support.'

Market Sentiment: ETF Speculation Drives DOGE Optimism

Market sentiment for Dogecoin appears overwhelmingly bullish as the SEC extends its review period for Bitwise's proposed Dogecoin ETF, with the first-ever Dogecoin ETF potentially launching on September 11. News of CleanCore Solutions' $68 million Dogecoin purchase and ZA Miner's promised cloud mining profits have further fueled institutional interest. BTCC financial analyst Robert notes, 'The convergence of ETF speculation, institutional adoption, and mainstream recognition is creating unprecedented momentum for Dogecoin, though investors should remain cautious of volatility spikes around regulatory decisions.'

Factors Influencing DOGE's Price

SEC Extends Review Period for Bitwise's Proposed Dogecoin ETF

The U.S. Securities and Exchange Commission has pushed back its decision deadline for Bitwise's Dogecoin ETF application to November 12, 2025. This marks a potential milestone as the first U.S.-listed investment fund tracking the meme cryptocurrency.

DOGE has demonstrated remarkable resilience, with prices surging 150% year-over-year despite recent market turbulence. Bitwise argues the asset's established liquidity and retail adoption make it suitable for ETF packaging.

Regulators cited the need for additional time to evaluate public concerns regarding Dogecoin's volatility and susceptibility to manipulation. The delay follows similar scrutiny faced by Grayscale during its earlier ETF attempt.

Dogecoin Price Prediction: Can DOGE Reach $1 by 2026 Amid Meme Coin Evolution?

Dogecoin's potential rally to $1 by 2026 dominates crypto discussions as the meme coin defies skepticism with a $35.32 billion market cap. Trading at $0.2337, DOGE saw a 183.48% surge in 24-hour volume to $3.1 billion—signaling renewed speculative interest. Yet its lack of technological differentiation raises questions about sustainability beyond viral hype.

The market contrasts Dogecoin's community-driven momentum with newer utility-focused tokens like Remittix (RTX). Meme coins now operate in a 2025 landscape where narrative and functionality collide. DOGE's fate hinges on broader crypto adoption and commercial integration, not just Elon Musk tweets.

SEC Reviews First Dogecoin ETF Amid Market Surge

Dogecoin's price surged 8% in the past 24 hours, reaching $0.24 with a market capitalization exceeding $35 billion. The rally follows intensified speculation about the potential approval of the first U.S. exchange-traded fund (ETF) for the meme coin. A decision could come as early as this week, marking a pivotal moment for the cryptocurrency originally inspired by internet culture and championed by figures like Elon Musk.

GoldenMining has capitalized on the bullish sentiment by launching Dogecoin Profit Contracts, offering fixed daily income through tiered investment options. The platform provides short-term and long-term contracts, including a $15 sign-up reward for new users to test the system. Contract tiers range from $100 investments yielding $8 returns to $650 commitments generating $42.25 in profits.

ZA Miner Promises $5,866 Daily Dogecoin Cloud Mining Profits as Investors Seek Stability in 2025

Cloud mining platforms are gaining traction as crypto investors shift focus from volatile price speculation to steadier income streams. ZA Miner has emerged as a standout, advertising daily Dogecoin mining profits up to $5,866. The platform differentiates itself through transparent profit-sharing mechanics and instant onboarding—new users receive a $100 bonus to begin mining immediately.

Dogecoin continues defying its meme-coin origins, trading at $0.25 in August 2025. Its resilience stems from an active community, merchant adoption, and utility in microtransactions. While Bitcoin becomes increasingly institutionalized, DOGE maintains grassroots appeal.

From Meme to Mainstream: Dogecoin's Decade-Long Evolution into a Viable Asset

What began as a satirical jab at Bitcoin's proliferating clones in 2013 has defied expectations. Dogecoin (DOGE), originally branded with a Shiba Inu mascot as a self-aware joke, now commands a top-10 market capitalization. The token's transition from internet tipping currency to institutional darling underscores crypto's capacity for unpredictable value creation.

Retail adoption surged through organic community growth and celebrity endorsements—notably Elon Musk's recurrent tweets. Payment processors and charities gradually integrated DOGE, lending legitimacy to its underlying blockchain. Today, platforms like ProfitableMining demystify DOGE mining, transforming speculative asset into passive income vehicle without requiring technical expertise.

First-Ever Dogecoin ETF Set to Launch September 11 Under '40 Act

The cryptocurrency market is poised for a historic milestone as the REX-OSPREY Dogecoin ETF prepares to launch on September 11. This marks the first U.S. fund exclusively dedicated to DOGE, a meme coin with intentionally no utility—a departure from traditional crypto ETFs. Bloomberg analyst Eric Balchunas confirmed the '40 Act filing, noting the fund could pioneer a new wave of meme-based investment vehicles.

Dogecoin's price surged 16% following the announcement, climbing from $0.21 to $0.245. The move reflects growing institutional recognition of meme coins, previously considered niche assets. REX-OSPREY's success with its Solana ETF likely paved the way for this unconventional offering.

Market observers anticipate ripple effects across the crypto ETF landscape. "This opens floodgates for other joke coins," Balchunas remarked, suggesting PEPE or SHIB funds could follow. The launch challenges conventional wisdom about what constitutes "serious" crypto investments.

CleanCore Solutions Stock Surges 38% After $68 Million Dogecoin Purchase

CleanCore Solutions (ZONE) saw its stock price jump 38% in after-hours trading following the announcement of a massive Dogecoin acquisition. The company purchased 285,420,000 DOGE tokens worth $68 million, funded by a recent $175 million capital raise from investors including Pantera and FalconX.

The microcap firm plans to aggressively expand its Dogecoin holdings, targeting 1 billion DOGE within 30 days. This move positions CleanCore to potentially control 5% of Dogecoin's total supply, creating significant buying pressure for the meme coin.

The market reaction underscores growing institutional interest in cryptocurrency assets, particularly those with strong community backing like Dogecoin. CleanCore's bold treasury strategy mirrors corporate Bitcoin accumulation plays but focuses on the more volatile meme coin sector.

Dogecoin Price Eyes Breakout as ETF Launch Speculation Heats Up

Dogecoin is gaining attention amid speculation about the potential launch of the Rex-Osprey DOGE ETF ($DOJE). If approved, this would mark the first U.S.-listed Dogecoin ETF, providing investors with indirect exposure to DOGE without custody concerns. Market sentiment and trading activity have surged, though price action remains volatile as whales exploit retail-driven momentum.

On-chain data reveals whales are actively shaping DOGE's price trajectory. A Santiment report indicates wallets holding 1M–10M DOGE now control 7.23% of the supply—their largest accumulation since December 2021. This cohort capitalized on August's ETF rumor cycle, selling into retail-driven rallies. Whale activity resurged this week with 118 transactions exceeding $1M in a single day, coinciding with DOGE's latest short-term peak.

Social metrics mirror this cyclical pattern. Dogecoin mentions spiked sharply on August 15 during initial ETF speculation, then retraced as traders executed classic 'buy the rumor, sell the news' strategies. With renewed September speculation, social volume is climbing again—suggesting the market remains hypersensitive to ETF-related catalysts.

The Surging Interest in Dogecoin: What Bold Moves Are Driving the Momentum?

Dogecoin, the prominent memecoin, has surged into the spotlight with two major developments fueling its momentum. Rex-Osprey's anticipated launch of a Dogecoin ETF this week promises to grant investors exposure to DOGE without direct ownership, with Polymarket data suggesting a 92% probability of approval. Blockchain analytics from Santiment reveal whale accumulation, as addresses holding 1-10 million DOGE have expanded their holdings to 7.23% of circulating supply—the highest level in four years.

Meanwhile, CleanCore Solutions has unveiled a $175 million treasury strategy to acquire Dogecoin, signaling institutional recognition of the asset's viability. These parallel developments—regulatory accessibility through ETFs and corporate adoption—are creating a perfect storm of retail and institutional demand, positioning Dogecoin for potential price discovery beyond its meme origins.

Dogecoin Volatility Highlights Institutional Interest Amid ETF Speculation

Dogecoin exhibited characteristic volatility, swinging 5.7% between $0.231 and $0.244 within a 24-hour period. The memecoin found firm support near $0.234, where institutional desks and whales accumulated positions, while resistance at $0.244 capped upside momentum. Late-session buying of 687.9 million tokens signaled strong absorption of selling pressure.

Technical patterns suggest brewing bullish momentum, with higher lows forming in the final hour of trading. A decisive break above $0.244 could open the path toward the psychologically important $0.25 level. Market participants attribute the heightened activity to hedging strategies in derivatives markets and anticipation of U.S. crypto ETF developments.

Will DOGE Price Hit 1?

Based on current technical indicators and market developments, reaching $1 by 2026 represents an ambitious but plausible target for DOGE. The current price of $0.237 would require approximately a 322% increase. Key factors supporting this potential include:

| Factor | Impact | Timeline |

|---|---|---|

| ETF Approval | High (Institutional inflows) | Short-term |

| Technical Breakout | Medium (Momentum building) | 1-3 months |

| Market Adoption | Growing (Mainstream acceptance) | Ongoing |

| Volatility Management | Critical (Risk factor) | Constant |

BTCC financial analyst Robert suggests, 'While $1 is achievable, investors should monitor ETF decisions closely and maintain realistic expectations given DOGE's historical volatility patterns.'